I’ve been investing in various real-estate crowdfunding platforms since early 2015 with minimum $1,000-$2,000 investments here and there. In August 2016, I put $10,000 into a new platform: automated real-estate loans from PeerStreet. I decided to wait a year and see how it worked out letting someone else pick your loans. For this type of lending, you have to be an accredited investor. Here’s my review after 14 months of being an investor.

The basic premise of PeerStreet is simple (and similar to other sites). Real estate equity investors want to take out short-term loans (6 to 24 months) and don’t fit the profile of a traditional mortgage borrower. They are professional investors with multiple properties, need bridge financing, or they are on a tight timeline. As a real-estate-backed loan investor, you lend them money at 6% to 12% and usually backed by a first lien on the property. The borrower stands to lose the equity in their property (I keep LTV under 70%), so they are highly incentivized to avoid default. In the worst case, you would foreclose and liquidate the property in order to get your money back. However, this is better than Prosper or LendingClub where it is an unsecured loan and your only recourse is to lower their credit score.

What are PeerStreet strengths? Here are the reasons that I decided to put more a higher amount of money into PeerStreet as compared to other worthwhile real estate marketplace sites:

- Debt-only focus. Other real estate (RE) sites will offer both equity and debt (and some thing in between). PeerStreet only focuses on debt, and I also prefer the simplicity of debt. There is limited upside but also less downside. Traditionally, this might be called “hard money lending”.

- Lower $1,000 investment minimum. Many RE investment sites have minimums of $10,000 or $25,000. A few will go down to $2,000 but there is not a steady supply. At PeerStreet, $25,000 will get me slices of loans from 25 real estate properties.

- Greater availability of investments. Amongst all of the RE websites that I have joined, PeerStreet has the highest and most steady volume of loans that I’ve seen. I dislike having idle cash just sit there, waiting and not earning interest. They apparently have a unique process where they have a network of lenders that bring in loans for them. This steady volume allows the lower $1,000 minimums and more diversification, as well as easy reinvestment of matured loans.

- Automated investing. The above two characteristics allow PeerStreet to run an automated investment program. You give them say $5,000 and they will invest it automatically amongst five $1,000 loans. You can set certain criteria (LTV ratio, term length, interest rate). When a loan matures, the software can automatically reinvest your available cash. I don’t even have to log in.

- Consistent underwriting. You should perform your own due diligence in this area, as you can only feel comfortable with automated investing if you think every loan is more or less underwritten fairly. The riskier loans get higher interest rates. The less-risky loans get lower interest rates. The shady borrowers are turned away. Otherwise, you’d want to pick and choose. After doing this for a year, I stopped wanting to pick and choose. I want to just sit back and let the software choose for me. We’ll see if it works out.

- Backed by Andreessen Horowitz and also Michael Burry. Andreessen Horowitz did the Series A funding. Michael Burry was an early seed investor, using $6.1 million of his own money according to TechCrunch. As profiled in The Big Short, Burry is known for being analytical to a fault, as opposed to being a good salesman.

Here’s a screenshot of the automated investing customizer tool:

(Tip: Even if you plan on investing only in $1,000 loans, once you are fully invested you might change later to a higher minimum like $1,250 in order to more quickly reinvest your idle cash. For example, if you have $78 in interest and then a $1,000 loan is paid off, then you could invest $1,078 automatically into your next loan.)

What is a potential PeerStreet drawback? In my opinion, slightly lower yields. This is just my limited understanding and I may be wrong, but PeerStreet has a network of lenders bringing in these deals and so the net yield to the investor feels lower than other sites. This “con” is also their secret sauce that brings in the high loan volume (and ideally the ability to be more selective), and so I am willing to earn lower interest rates for the added diversification and convenience of automated investing.

Here’s the 1-minute video pitch from PeerStreet:

How does PeerStreet make money? As with other real estate marketplace lenders, they charge a servicing fee. PeerStreet charges between 0.25% and 1%, taken out from the interest payments. This way, PeerStreet only gets paid when you get paid. When you invest, you see the fee and net interest rate that you’ll earn. In exchange, they help source the investments, set up all the required legal structures, service the loans, and coordinate the foreclosure process in case of default. In some cases, the originating lenders retains a partial interest in the loan (“skin in the game”). Here’s a partial screenshot:

What if PeerStreet goes bankrupt? This is the same question posed to LendingClub and Prosper, and their solution is also the same. The loans are held in a bankruptcy-remote entity and will continue to be serviced by a third-party even in a bankruptcy event. From their FAQ:

PeerStreet also holds loans in a bankruptcy-remote entity that is separate from our primary corporate entity. In the event PeerStreet no longer remains in business, a third-party “special member” will step in to manage loan investments and ensure that investors continue to receive interest and principal payments. Additionally, investor funds are held in an Investors Trust Account with City National Bank and FDIC insured up to $250,000.

Tax forms? In general, unless you use a self-directed IRA, the interest earned will be taxed as ordinary income (like bank account interest). For tax year 2016, I received a simple 1099-INT and filing it with my income taxes was easy. Here’s what PeerStreet says:

PeerStreet investors will be issued a consolidated Form 1099 for the income distributed from their investment positions. Investors may receive one or more of the following types of 1099 form:

1099-OID for notes with terms longer than one year (at the time of issue)

1099-INT for notes with terms less than one year (at the time of issue)

1099-MISC for incentives, late fees or other income, if more than $600.

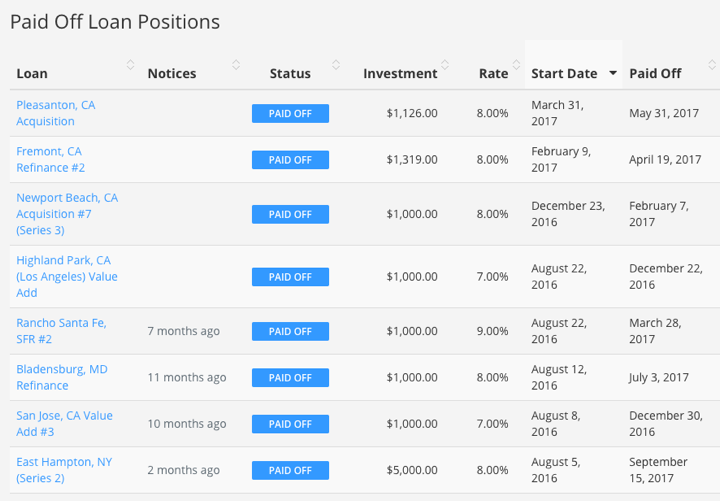

My investment performance. I starting investing with $10,000 in August 2016. I’ve already had over $10,000 in loan value paid back already, but I chose to reinvest immediately. As of this writing in 10/1/2017, my total account value is $10,863.46 invested across 10 different loans after reinvestment. My interest to date is $863.46, which works out to 7.7% annualized return net of all fees and taking into account the short periods where my cash was idle. Here are screenshots of my paid-off loans and a chart of cumulative interest earned.

Now, I don’t know what the default rate is overall, but sooner or later I will probably experience one. This will require patience as it will take a while for the foreclosure process to play out. In my experience, this is a critical difference with private real estate loans. You can’t make a few clicks and get your money back at the current market price. I might have to wait months or even more than a year. The good news that with a hard asset as collateral, eventually I have a solid chance of getting my money back with interest. I am willing to accept this illiquidity and hopefully earn higher returns in exchange.

Update: As of October 2017, PeerStreet has stated they have originated $500 million of loans with zero investor losses.

Bottom line. PeerStreet offers high-yield, short-term loans backed by private real estate. Instead of traditional “hard money lending”, accredited investors can diversify with only $1,000 minimum in properties nationwide with automatic investments, without having to do any physical legwork. The number of new, available investments is better than competitors in my experience. Will it provide superior risk-adjusted returns as compared to other high-yield bonds? I don’t know, but my experience so far after 14 months has been positive.

If you are interested and are an accredited investor, you can sign-up for free and browse investments at PeerStreet before depositing any funds or making any investments.

See also my previous investments: Patch of Land (accredited only), a debt investment backed by a single-family residential property in California. Fundrise eREIT (open to public), a basket of commercial property investments with an equity focus. RealtyShares, a debt investment backed by a 6-unit apartment complex.

PeerStreet Review: Real Estate Backed Loan Investments, My 14-Month Experience from My Money Blog.

© MyMoneyBlog.com, 2017.

Read More: PeerStreet Review: Real Estate Backed Loan Investments, My 14-Month Experience